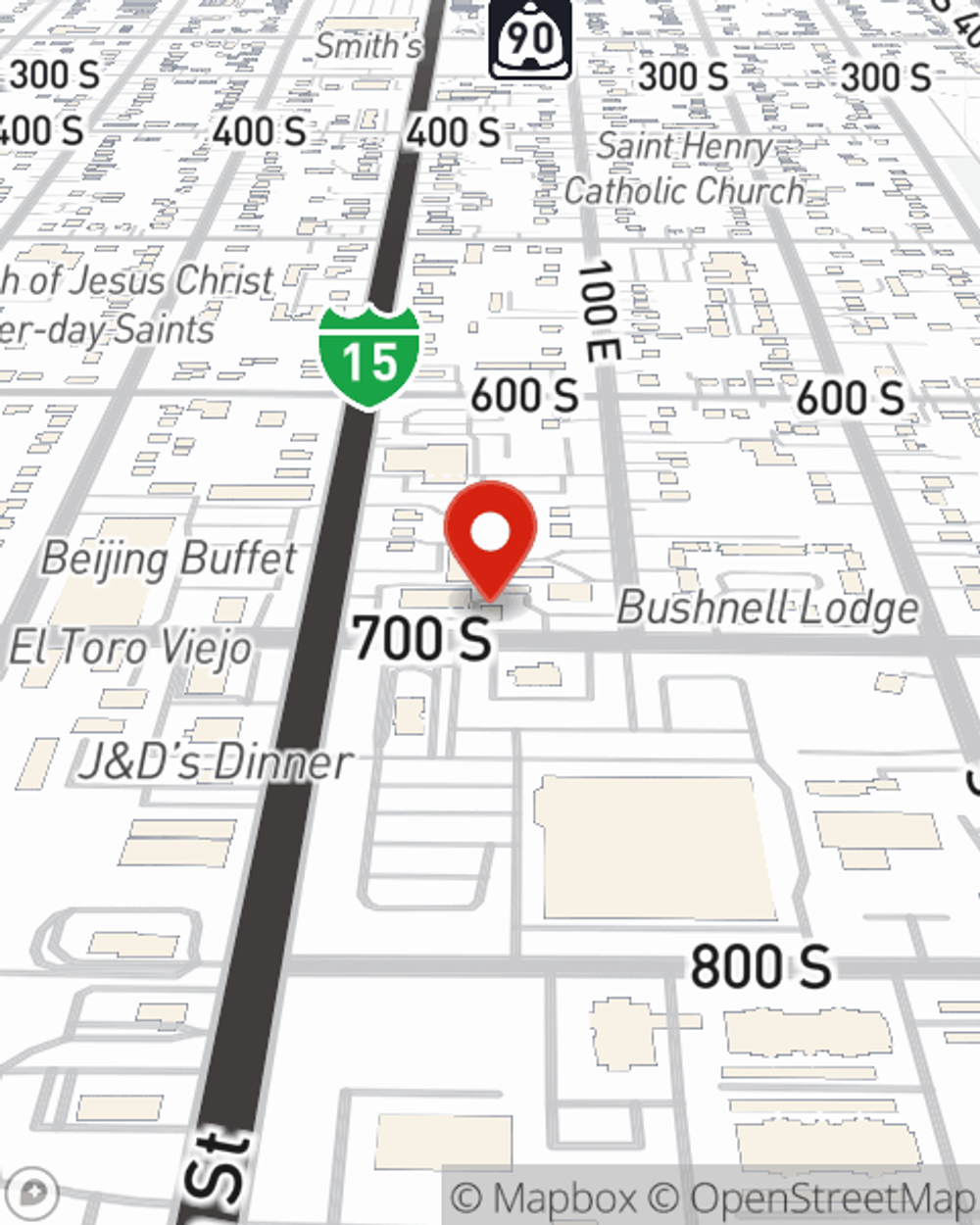

Auto Insurance in and around Brigham City

Auto owners in the Brigham City area, State Farm can help with your insurance needs.

Take this route for your insurance needs

Would you like to create a personalized auto quote?

- Brigham City

- PERRY

- WILLARD

- HONEYVILLE

- CORINNE

- GARLAND

- TREMONTON

- LOGAN

- MANTUA

- NORTH OGDEN

- BOX ELDER COUNTY

- CACHE VALLEY

Here When The Unexpected Arrives

Choosing your auto insurance provider doesn't have to be overwhelming. With State Farm, you can be sure to receive dependable coverage. Among all the different options out there for deductibles and savings options, State Farm makes the decision easy.

Auto owners in the Brigham City area, State Farm can help with your insurance needs.

Take this route for your insurance needs

Your Quest For Auto Insurance Is Over

With State Farm, you won’t have to sort it out alone. Your State Farm Agent Dan Price can help you understand your coverage options. You'll get the excellent auto insurance coverage you need.

Visit State Farm Agent Dan Price today to see how a State Farm auto policy can meet your auto needs here in Brigham City, UT.

Have More Questions About Auto Insurance?

Call Dan at (435) 723-8798 or visit our FAQ page.

Simple Insights®

Times to review your insurance

Times to review your insurance

Consider completing an insurance review to confirm that you, your family, home, car and property are insured.

Personal property and casualty insurance

Personal property and casualty insurance

What is Personal Property and Casualty Insurance? Learn more information on automobile, homeowners, watercraft, condo, renters and more.

Simple Insights®

Times to review your insurance

Times to review your insurance

Consider completing an insurance review to confirm that you, your family, home, car and property are insured.

Personal property and casualty insurance

Personal property and casualty insurance

What is Personal Property and Casualty Insurance? Learn more information on automobile, homeowners, watercraft, condo, renters and more.